When you first launched your Limited Liability Company (LLC), bringing on a partner was an exciting step, full of shared vision and combined resources. However, as businesses evolve, partnerships sometimes run their course. Whether due to fundamental disagreements, a shift in professional focus, retirement, or simply a need for a structural change, the remaining members often face the difficult, yet necessary, task of removing a partner—a process almost universally handled through a formal buyout.

A poorly managed partner exit can be catastrophic, potentially dissolving the entire company, triggering lawsuits, or jeopardizing the core liability protection of the LLC. Conversely, a structured, legally compliant buyout ensures a smooth transition, protects the remaining members' assets, and guarantees business continuity. This comprehensive guide breaks down the essential steps for legally and successfully removing a partner from an existing LLC via a member buyout.

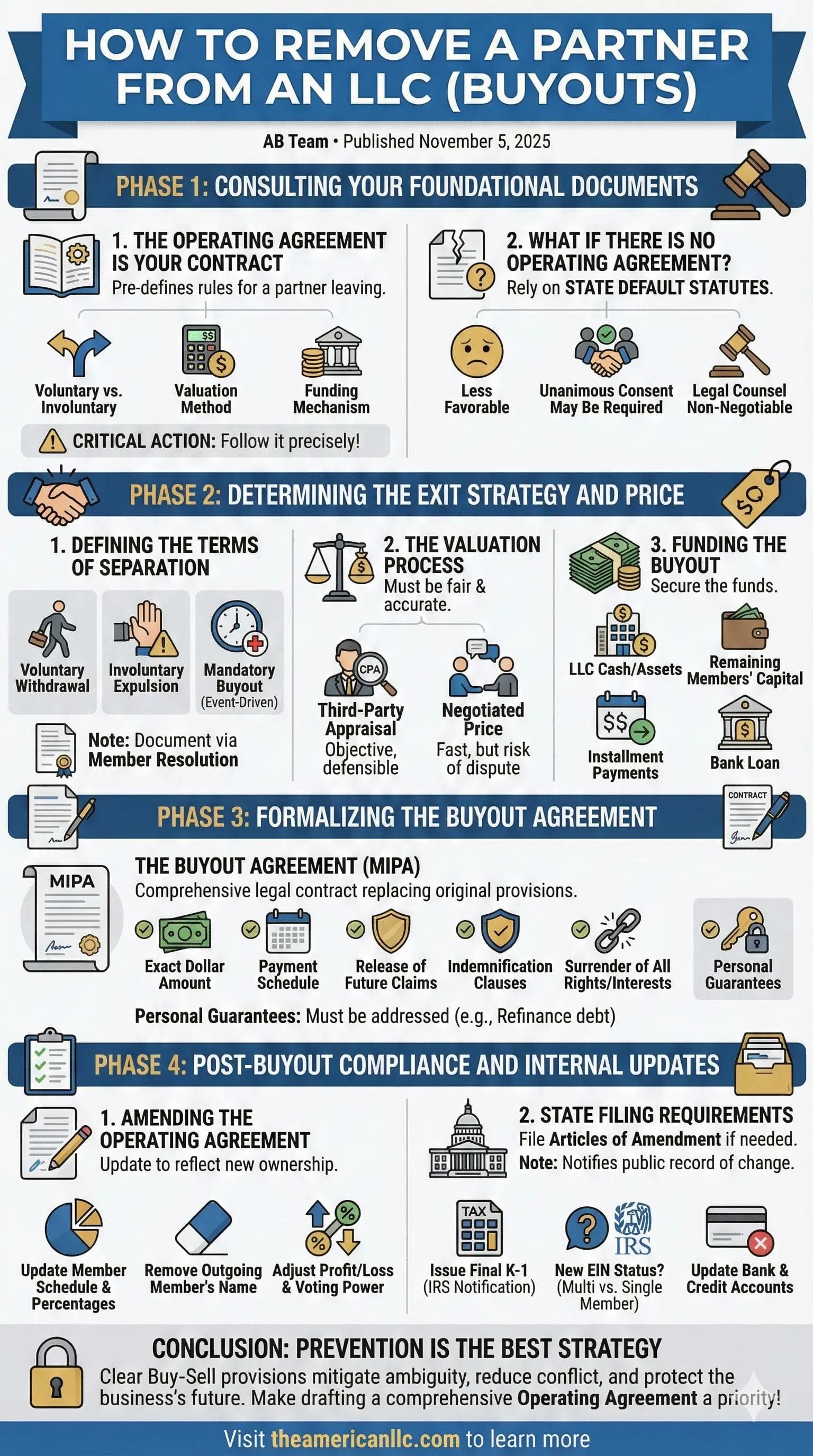

Phase 1: Consulting Your Foundational Documents

The single most important document governing any partner removal is your LLC’s Operating Agreement. Before taking any action, you must immediately reference this document.

1. The Operating Agreement is Your Contract

Your Operating Agreement should contain a section dedicated to “Buy-Sell Provisions” or “Transfer of Interest.” This section pre-defines the rules for a partner leaving, including:

- Voluntary vs. Involuntary Withdrawal: Does the agreement distinguish between a partner choosing to leave and one being expelled (e.g., for breach of fiduciary duty)?

- Valuation Method: The agreement should specify how the exiting partner’s equity will be valued. Common methods include a fixed price, a formula based on revenue (e.g., 3x annual profit), or mandatory third-party appraisal.

- Funding Mechanism: It may stipulate how the buyout will be funded (e.g., using business cash, insurance policies, or installment payments).

Critical Action: If the Operating Agreement clearly outlines the removal process, you must follow it precisely. Ignoring your own governing document is a guarantee for legal dispute.

2. What If There Is No Operating Agreement?

If your LLC does not have an Operating Agreement (a common but dangerous oversight), or if the existing agreement is silent on buyouts, the situation becomes much more complex. You must rely on the default LLC statutes of the state in which your business is registered. State law may be less favorable, potentially requiring unanimous member consent or imposing statutory dissolution procedures that are cumbersome and expensive. In this scenario, legal counsel is non-negotiable.

Phase 2: Determining the Exit Strategy and Price

1. Defining the Terms of Separation

There are generally three ways a partner leaves an LLC, each impacting the buyout structure:

- Voluntary Withdrawal: The partner simply decides to leave.

- Involuntary Expulsion: The remaining members force the partner out (usually for cause, as defined in the Operating Agreement, such as theft, gross negligence, or breach of contract).

- Mandatory Buyout (Death or Disability): Triggered by an event, often funded by a key-person life or disability insurance policy.

The remaining partners must formally vote on the decision and document the outcome via a Member Resolution, even if the separation is amicable.

2. The Valuation Process

This is where most disputes arise. The valuation must be fair and accurate to prevent later claims of financial coercion. If the Operating Agreement provides a formula, use it. If not, you must agree on a method:

- Third-Party Appraisal: Hiring a Certified Public Accountant (CPA) or a professional business valuation firm provides an objective, defensible value for the exiting member's interest. This is the safest route for mitigating conflict.

- Negotiated Price: The members agree on a price. While fast, this method can lead to residual resentment or future legal challenges if one party feels they were shortchanged.

3. Funding the Buyout

Once the price is set, the funds must be secured. Common funding sources include:

- LLC Cash/Assets: Using working capital or selling business assets (e.g., property, equipment).

- Remaining Members’ Capital: The remaining partners individually contribute personal funds to purchase the interest.

- Installment Payments: The LLC pays the exiting member over a set period (e.g., 5 years) via a promissory note, often secured by collateral.

- Bank Loan: The LLC secures a small business loan to cover the lump-sum payment.

Phase 3: Formalizing the Buyout Agreement

The separation is formalized through a comprehensive legal contract known as a Buyout Agreement, Redemption Agreement, or Membership Interest Purchase Agreement (MIPA). This document replaces the initial Operating Agreement provisions and covers all necessary details.

The MIPA must clearly stipulate:

- The exact dollar amount being paid for the interest.

- The payment schedule (lump sum or installment payments).

- A release of all future claims against the LLC by the departing member.

- The indemnification clauses, protecting the remaining members from future liabilities associated with the exiting partner's past actions.

- Confirmation that the departing member surrenders all rights, titles, and interests in the LLC.

Note on Personal Guarantees: If the departing partner had previously signed personal guarantees for business debt (e.g., bank loans, leases), the Buyout Agreement must explicitly address how these guarantees will be removed or transferred. Banks are often reluctant to release a guarantor, meaning the LLC may need to refinance the debt in the names of the remaining members.

Phase 4: Post-Buyout Compliance and Internal Updates

The buyout is not complete until all legal and internal compliance steps are finished. This phase is critical to maintaining the integrity of the LLC’s liability shield.

1. Amending the Operating Agreement

The original Operating Agreement is now obsolete. You must draft and execute an amendment reflecting the change in ownership, specifically:

- Updating the schedule of members (who owns what percentage).

- Removing the outgoing member’s name and signature from the document.

- Adjusting profit/loss distribution and voting power to reflect the new ownership percentages.

2. State Filing Requirements (Articles of Amendment)

Depending on your state's laws, if the departing member was listed as a Manager or Organizer in the initial Articles of Organization, you may need to file an official Amendment to the Articles of Organization with the Secretary of State. This notifies the public record that the individual is no longer associated with the management structure.

3. Financial and Tax Compliance

- IRS Notification: The LLC must issue a final K-1 to the departing member for the year, reporting their share of income or loss up to the date of the buyout.

- New EIN Status: If the LLC changes from a multi-member LLC (taxed as a partnership) to a single-member LLC, its tax classification changes. The IRS will automatically treat the new single-member LLC as a "Disregarded Entity" unless an S-Corp or C-Corp election is made. This change requires immediate notification to the IRS to ensure proper tax filing moving forward.

- Bank Updates: Remove the outgoing partner from all business bank accounts, credit card accounts, and lines of credit.

Conclusion: Prevention is the Best Strategy

Removing a partner via a buyout is a sensitive and complex endeavor. While the process outlined above provides a roadmap for separation, the most effective way to handle future exits is through preparation. If your LLC does not yet have a comprehensive Operating Agreement with detailed Buy-Sell provisions, make drafting one your top priority. Clear, pre-agreed terms mitigate ambiguity, reduce conflict, and protect the financial future of your business.