For decades, the United States has been seen globally as a premier destination for business formation, but this ease of incorporation often came with a lack of transparency regarding who truly owns and controls private companies. That era officially ended with the passage of the Corporate Transparency Act (CTA) in 2021 and its key mechanism: the Beneficial Ownership Information (BOI) Report.

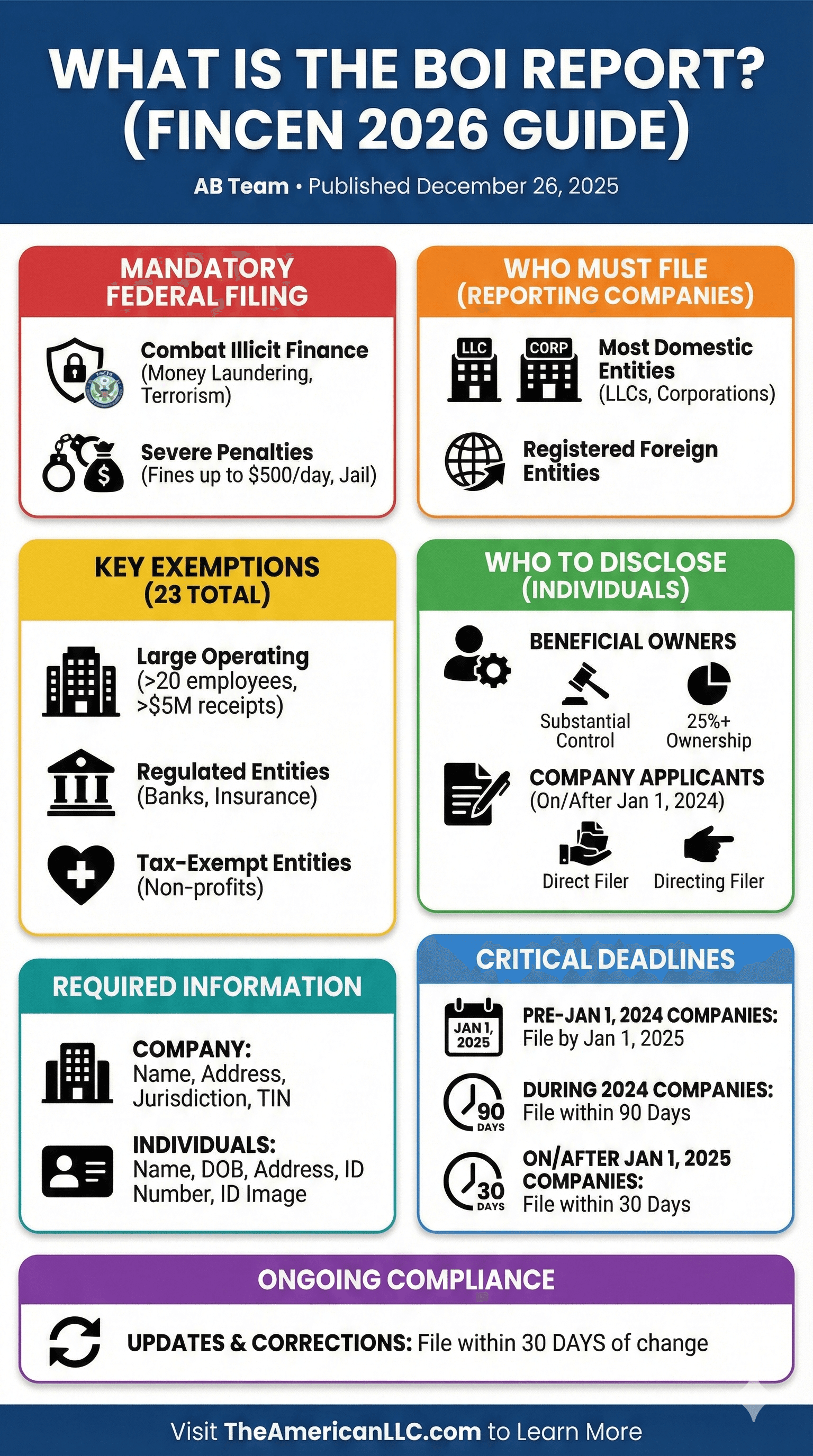

If you own or operate a Limited Liability Company (LLC), Corporation, or other private entity in the U.S., the BOI Report is not optional—it is a mandatory federal filing requirement that dramatically shifts compliance responsibilities. Failure to comply can result in severe civil and criminal penalties, including fines up to $500 per day and possible jail time.

This guide breaks down the essential details of the BOI Report, explaining what it is, who must file it, what information FinCEN requires, and the critical deadlines you need to meet to ensure your business remains compliant.

What Exactly is the Beneficial Ownership Information (BOI) Report?

The BOI Report is a filing mandated by the Corporate Transparency Act (CTA), which is administered by the Financial Crimes Enforcement Network (FinCEN), a bureau of the U.S. Department of the Treasury. The primary goal of the CTA is to combat illicit finance, including money laundering, terrorism financing, and tax fraud, by creating a comprehensive database of the individuals who ultimately own or control reporting companies.

This report requires covered entities—known as “Reporting Companies”—to disclose identifying information about their “Beneficial Owners” and, for new companies, the individuals who filed the company’s formation documents (the “Company Applicants”). This information is submitted electronically to FinCEN and is stored in a secure, non-public database accessible only by authorized government agencies, law enforcement, and, in certain circumstances, financial institutions.

Who Must File: Identifying Your “Reporting Company”

The CTA defines a “Reporting Company” broadly. Generally, if your business was created by filing a document with a state secretary of state (or similar office), it is likely a Reporting Company. This includes the vast majority of:

- Domestic Entities: LLCs, Corporations, and any other entities created under the law of a State or Indian Tribe.

- Foreign Entities: Entities formed under the law of a foreign country that are registered to do business in the U.S. through a filing with a state or tribal secretary of state.

The 23 Exemptions: Who Does NOT Need to File?

FinCEN recognizes 23 specific exemptions for entities that are already heavily regulated or large enough to pose a lower risk of misuse. The most common exemptions are:

- Large Operating Companies: Entities that have more than 20 full-time employees in the U.S., an operating presence at a physical office in the U.S., and reported more than $5 million in gross receipts or sales on the previous year's federal income tax return.

- Regulated Entities: Banks, credit unions, insurance companies, public accounting firms, and public utility companies.

- Tax-Exempt Entities: Certain organizations, including most 501(c)(3) non-profits.

If your LLC or small business does not fit neatly into one of these 23 categories—and most small businesses, rental LLCs, and holding companies do not—you must file the BOI Report.

Defining the Key Roles: Beneficial Owners and Company Applicants

1. Beneficial Owners

A Beneficial Owner is any individual who, directly or indirectly, either:

- Exercises Substantial Control: This is a broad category designed to catch anyone with significant influence over the company’s important decisions, regardless of formal title. This typically includes CEOs, Presidents, General Counsel, and senior officers, as well as individuals who have the authority to appoint or remove officers or the majority of the governing body.

- Owns or Controls 25% or More of the Ownership Interests: This includes equity, stock, capital or profit interests, convertible instruments, and any other mechanisms for establishing ownership.

2. Company Applicants

The Company Applicant requirement only applies to companies formed on or after January 1, 2024. This refers to a maximum of two individuals:

- The person who directly files the document that creates the Reporting Company (e.g., the paralegal or formation service employee).

- The person who is primarily responsible for directing or controlling the filing of the formation document (e.g., the business owner or lawyer who instructed the filing).

What Information Must Be Disclosed to FinCEN?

The BOI Report requires specific, detailed information for both the Reporting Company and each identified Beneficial Owner and Company Applicant.

For the Reporting Company:

- Full legal name and any trade names (DBAs).

- The current street address of the principal place of business.

- Jurisdiction of formation (state or foreign country).

- Taxpayer Identification Number (TIN), or Foreign TIN if applicable.

For Each Beneficial Owner and Company Applicant:

- Full legal name.

- Date of birth.

- Current residential street address (for Beneficial Owners) or business address (for Company Applicants who file in the course of their business).

- An identifying number from a non-expired U.S. passport, state driver’s license, or state identification document.

- An image of the document from which the identifying number was obtained.

Critical Filing Deadlines to Remember

The deadlines depend entirely on when your Reporting Company was created:

- Companies Formed Before January 1, 2024: These existing companies must file their initial BOI Report by January 1, 2025.

- Companies Formed During 2024: These companies must file their initial report within 90 calendar days after receiving actual or public notice that their company formation is effective.

- Companies Formed On or After January 1, 2025: These companies must file their initial report within 30 calendar days after receiving actual or public notice that their company formation is effective.

The Crucial Requirement for Updates and Corrections

Unlike some tax forms, the BOI Report is not a one-time filing. Any change in the reported beneficial ownership information—such as a new owner, a change in residential address, a name change, or a new CEO—must be reported to FinCEN within 30 calendar days of the change occurring. Corrections for inaccurate information must also be filed within 30 days of the company becoming aware of the inaccuracy.

Navigating BOI Compliance: FinCEN IDs and Strategy

To streamline the reporting process, FinCEN offers the option for individuals (Beneficial Owners and Company Applicants) to obtain a “FinCEN Identifier.” This is a unique number that the individual can provide to all reporting companies they are associated with, rather than repeatedly providing their name, birth date, address, and photo ID image.

While compliance may seem like a bureaucratic headache, the CTA is a seismic shift in business regulation. The penalties for non-compliance are severe, making it absolutely necessary for every business owner to assess their reporting obligations now. Do not wait for the deadline to approach; determine if your company is a Reporting Company, accurately identify all Beneficial Owners, and establish a clear internal process for reporting any future changes within the tight 30-day window.