When launching or scaling a business, the entity structure you choose is fundamental. While state law determines whether you are an LLC or a Corporation, federal tax law often allows you to choose how your entity is treated for income tax purposes. This critical flexibility is managed through a single IRS document: Form 8832, Election Classification.

For entrepreneurs running a Limited Liability Company (LLC), a key advantage is its default “pass-through” tax status, meaning the business itself does not pay income tax; instead, profits and losses are passed through to the owners' personal tax returns. However, there are strategic situations where the default treatment is not the most advantageous. That's where Form 8832 comes in. It’s the mechanism by which an eligible entity, such as an LLC, notifies the IRS that it wishes to be taxed as a Corporation—either a C-Corporation or, in specific cases, an S-Corporation (though the latter requires an additional filing, Form 2553).

What is IRS Form 8832: Entity Classification Election?

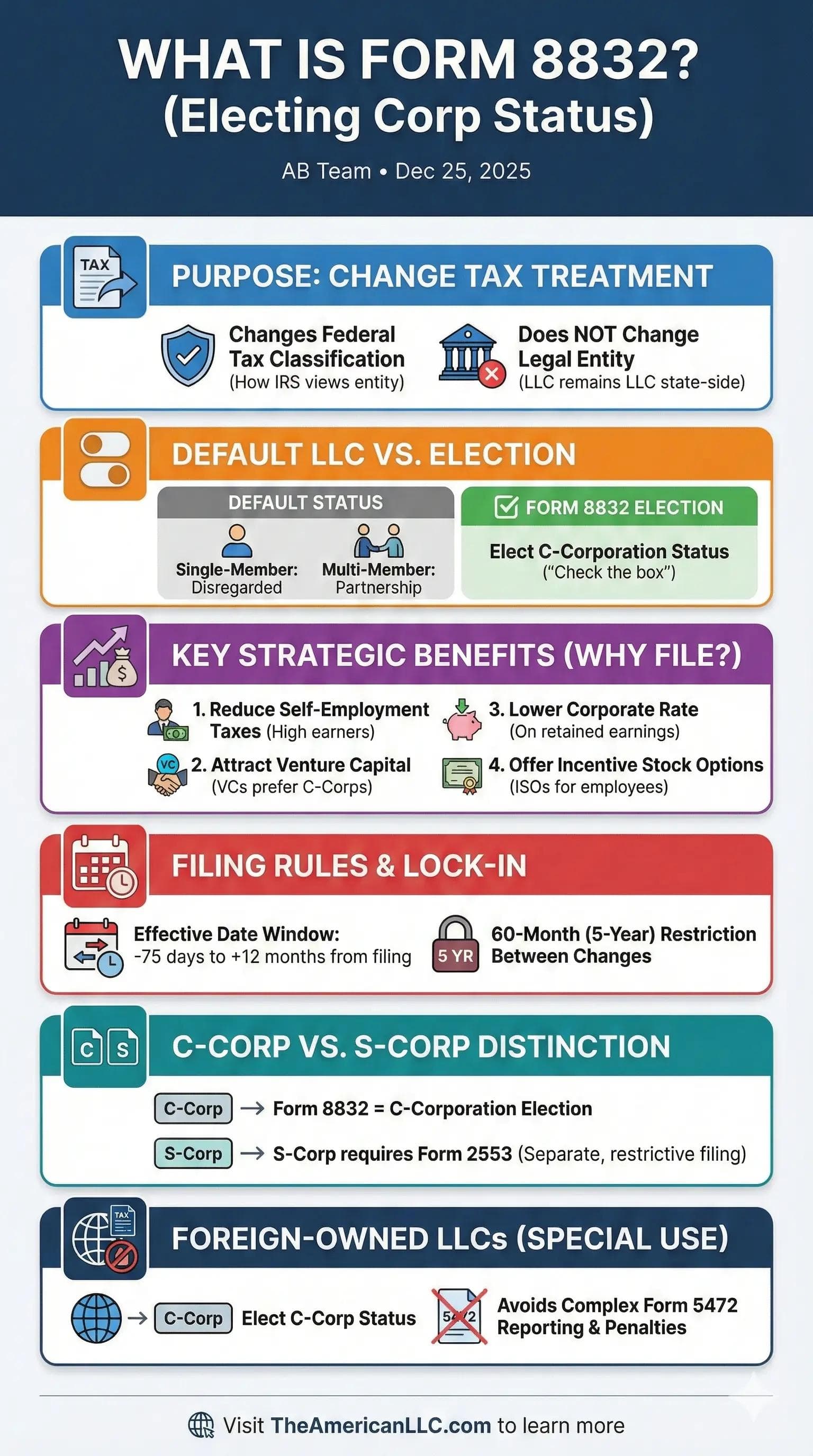

Form 8832 is used by eligible entities—primarily LLCs—to make or change their federal tax classification. It is important to understand that filing this form does not change your legal structure under state law; your LLC remains an LLC for liability and administrative purposes. It only changes how the IRS views your entity for tax computation.

The Default vs. Elective Classification

The rules for which tax status an LLC defaults to depend on the number of members:

- Single-Member LLC: Defaults to a Disregarded Entity (taxed as a Sole Proprietorship).

- Multi-Member LLC: Defaults to a Partnership.

By filing Form 8832, these LLCs can elect to be treated as a Corporation. Specifically, they choose to be taxed as a C-Corporation. This decision is often referred to as "checking the box" because of how the election is marked on the form itself.

When Should an LLC File Form 8832?

The decision to elect corporate tax status is significant and should never be made without consulting a tax professional. While the pass-through method is generally simpler, there are several strategic reasons why an LLC might choose to be taxed as a C-Corp via Form 8832:

1. Reducing Self-Employment Taxes

For high-earning LLC owners, the entire net income of a disregarded entity or partnership is subject to self-employment taxes (Social Security and Medicare). When an LLC elects C-Corporation status, the owners become employees of the C-Corp and are paid a W-2 salary. Only the W-2 salary is subject to self-employment tax. Any remaining profits distributed as dividends are taxed at the corporate level and then again at the shareholder level (double taxation), but they are not subject to self-employment tax. This trade-off requires careful analysis to ensure the benefit outweighs the double taxation cost.

2. Preparing for Investor Funding (Venture Capital)

Venture Capital (VC) firms and institutional investors overwhelmingly prefer to invest in C-Corporations. They require C-Corp status primarily because S-Corps have restrictions on the number and type of shareholders (e.g., they cannot have corporate shareholders), and pass-through entities create complicated tax compliance issues for investors. If your LLC intends to seek significant outside investment, filing Form 8832 to elect C-Corp status is often a prerequisite.

3. Utilizing Corporate Tax Rate Advantages

The corporate tax rate (currently a flat 21%) may be lower than the owner’s individual income tax rate, especially for individuals in the highest tax brackets. If the business plans to retain a significant amount of earnings for reinvestment rather than distribution, electing C-Corp status can provide tax savings on those retained earnings.

4. Facilitating Stock Option Plans

Only C-Corporations can offer Incentive Stock Options (ISOs) to employees. For fast-growing startups that rely heavily on equity compensation to attract talent, the corporate tax election is often necessary to establish robust equity plans.

The Mechanics of Filing Form 8832

Form 8832 is a relatively short, two-page form, but the timing and procedure are critical:

Choosing an Effective Date

Part I of the form requires you to select the effective date of the election. This date cannot be more than 75 days before the date you file the form, and it cannot be more than 12 months after the date you file the form. Choosing the effective date accurately is crucial for defining the start of the new tax year.

Consent and Notification

All owners of the entity must consent to the election. Additionally, the IRS requires that you attach a copy of the completed Form 8832 to the entity’s tax return for the year the election is effective (e.g., Form 1120 for a C-Corp). You must also notify all affected parties, including shareholders, partners, or members, of the new classification.

The Form 8832 Deadlines and Late Filing

If you are making an initial election to be classified as a corporation, the form must generally be filed by the due date of the tax return for the year the election is to be effective. However, the IRS allows for a substantial window for initial filing.

The rules become strict if you are attempting to change an existing tax election. Once an entity elects to change its classification, it generally cannot change its classification again for 60 months (five years). This prevents businesses from frequently switching tax structures to game the tax code.

Relief for Late Elections

Missing the deadline can be remedied, but it requires complexity. The IRS provides relief under Revenue Procedure 2009-41, which allows for a late election if certain conditions are met, such as demonstrating that the failure to file timely was due to reasonable cause. This often requires the entity to file its tax returns consistent with the intended election (e.g., filing Form 1120 even though Form 8832 was never filed) and seeking an extension of time to file the election.

C-Corp vs. S-Corp Election: The Crucial Difference

It is a common point of confusion for entrepreneurs: Form 8832 elects classification as a C-Corporation, not an S-Corporation. An S-Corporation is a special tax status that allows a corporation to be taxed under the pass-through rules while retaining some corporate benefits.

To achieve S-Corporation status, an LLC must:

- First, file Form 8832 to elect C-Corporation status (though some tax professionals will skip this step if the LLC is eligible and file only the next form).

- Second, file

The S-Corp election is highly restrictive, with limitations on the number of shareholders (maximum 100), shareholder types (no corporations or partnerships can be shareholders), and only one class of stock. Due to these restrictions, rapidly growing startups seeking VC funding typically avoid S-Corp status and stick with the C-Corp election established via Form 8832.

Foreign-Owned LLCs and Form 8832

Form 8832 holds particular significance for single-member LLCs owned by non-U.S. residents.

By default, a foreign-owned single-member LLC is treated as a disregarded entity. However, under a 2017 IRS regulation, these disregarded foreign-owned LLCs are

To escape the complexity and potential $25,000 penalties associated with Form 5472, many foreign entrepreneurs choose to file Form 8832 to formally elect C-Corporation status. While this introduces corporate tax rules, it resolves the specific reporting mandate of Form 5472, which is often considered the greater compliance burden for these entities.

Conclusion: The Strategic Importance of Tax Classification

Form 8832 is more than just a bureaucratic checkbox—it is a powerful strategic tool that allows business owners to divorce their legal entity structure (LLC) from their tax structure (C-Corporation). This flexibility is vital for maximizing tax efficiency, positioning the company for large-scale investment, and managing complex international compliance obligations.

Navigating entity classification involves understanding both state and federal rules, as well as the long-term impact on self-employment taxes, potential investors, and corporate tax rates. Entrepreneurs considering a tax status change should seek guidance from a qualified CPA or tax attorney to ensure the election is made correctly and serves the best financial interests of the business.