For entrepreneurs and investors prioritizing anonymity, choosing the right state for your Limited Liability Company (LLC) is as critical as choosing your business name. In the quest for maximum privacy, two states consistently rise to the top of the discussion: Nevada and Wyoming. Both have built national reputations as strong havens for asset protection, but when you look closer at the filing requirements, fee structures, and legal precedents, a clear difference emerges in which state truly offers the highest degree of anonymity.

This comprehensive guide breaks down the privacy features, costs, and strategic advantages of forming an LLC in Nevada versus Wyoming, helping you decide which state provides the impenetrable shield you need for your personal identity and assets.

The Privacy Showdown: Why Anonymity Matters for LLC Owners

The primary goal of an Anonymous LLC is to create a legal firewall between your personal name and the public record of your business ownership. This shield is essential for investors, real estate owners, and entrepreneurs concerned about privacy risks, frivolous lawsuits, or competitive intelligence. Privacy is typically achieved through two key mechanisms:

- No Public Listing of Members/Managers: The state does not require the names of the owners (members) or day-to-day operators (managers) to be listed on public formation documents.

- Strong Asset Protection Laws: State laws that prevent a creditor from seizing the LLC's assets or forcing the sale of an ownership interest to satisfy a personal judgment against a member.

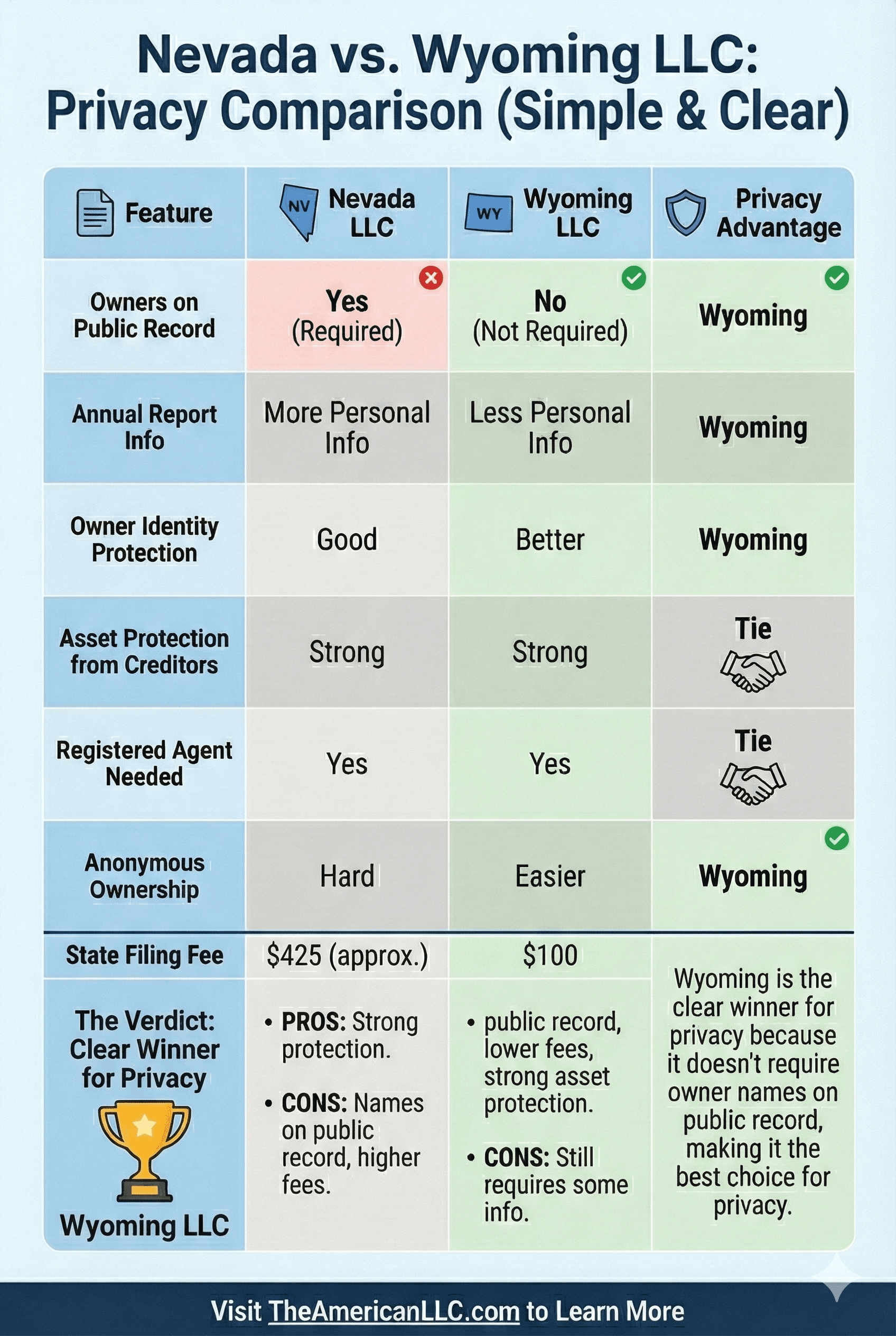

Nevada and Wyoming both offer advanced layers of protection, but their specific requirements for public disclosure vary.

Wyoming LLC: The Uncontested Leader in Simplicity and Privacy

Wyoming is widely recognized as the birthplace of the LLC in the United States and has maintained one of the strongest, most straightforward privacy stances in the country. For many, Wyoming is the gold standard for anonymity.

Key Privacy Features of Wyoming

- No Public Listing of Members or Managers: Wyoming does not require the names of the LLC’s members (owners) or managers to be listed on the initial Articles of Organization or the annual report. This is the single most important factor for privacy.

- Designated Registered Agent: The only name publicly associated with your LLC will be your Registered Agent, a required third-party service whose job is to receive legal mail on behalf of the business.

- Charging Order Protection: Wyoming offers excellent "Charging Order Protection." In a legal judgment against an LLC member, a creditor is typically limited to a charging order—meaning they can only collect distributions if and when the LLC decides to make them. Critically, Wyoming’s law specifies that a charging order is the sole remedy

- Low Annual Fees: The annual filing fee is minimal (currently $60) and does not increase based on the value of the assets held by the LLC.

The core advantage of Wyoming is its simplicity: file your LLC, list your registered agent, and your identity as an owner remains off the public record. This streamlined approach makes it the preferred choice for digital nomads and real estate holding companies seeking the most direct path to privacy.

Nevada LLC: Robust Protection with a Higher Price Tag

Nevada is another popular state for asset protection, primarily due to its historically favorable business laws and zero state corporate or personal income tax. Nevada offers powerful legal barriers but often comes with significantly higher administrative costs and a slightly less secure privacy environment than Wyoming.

Key Privacy Features of Nevada

- Flexibility with Manager Listings: Nevada requires the name and address of the LLC’s manager

- Utilizing Nominee Managers: To achieve true anonymity in Nevada, owners often must employ a "nominee manager" service—a professional third party who is listed on the public record as the manager. This adds a layer of complexity and an additional annual service fee.

Strong Anti-Veil-Piercing Law: Nevada has exceptionally strong statutes designed to protect the "corporate veil" from being pierced, meaning it is very difficult for creditors to reach past the LLC to the owner’s personal assets. High Annual Fees: Nevada imposes a significantly higher annual filing fee (currently $350) and requires a hefty initial business license fee ($200), making the total annual cost much higher than Wyoming.

While Nevada’s asset protection laws are impressive, the requirement to list a manager publicly means that achieving true anonymity requires the extra step and cost of using a nominee service, eroding some of its simplicity and cost-effectiveness compared to Wyoming.

The Direct Comparison: Wyoming vs. Nevada for Anonymity

When stacking these two powerhouse states against each other, the differences become clear based on your priorities:

Feature Wyoming LLC Nevada LLC Member/Owner Privacy (Public Record) Annual Compliance Cost Charging Order Protection (SMLLC) Tax Advantages No state corporate or personal income tax. No state corporate or personal income tax.

Why Wyoming Wins the Privacy Battle

For the average entrepreneur, investor, or privacy seeker, Wyoming stands out as the superior choice due to two major factors:

1. Absolute Simplicity in Anonymity

Wyoming makes anonymity the default setting. You do not need to pay for an external manager or worry about complex structuring to keep your name off the public record. You only need a Registered Agent, which is a standard requirement everywhere. This simplicity translates directly to peace of mind and lower administrative effort.

2. Cost-Effectiveness

The administrative burden and cost difference are substantial. Nevada’s high annual fees and the requirement to potentially hire a nominee manager drive up the cost of maintaining a private LLC significantly. Wyoming provides the same, if not greater, degree of statutory anonymity for a fraction of the price.

Advanced Strategy: The "Series LLC" in Both States

It is important to note that both Nevada and Wyoming offer the

- Wyoming Series LLC: Wyoming was one of the first states to adopt the Series LLC, and its framework is considered robust.

- Nevada Series LLC: Nevada also offers the Series LLC, providing similar high-level asset compartmentalization.

For large-scale real estate investors or those with diverse portfolios, the Series LLC is an invaluable feature available in both states, reinforcing their status as top-tier asset protection jurisdictions.

Conclusion: Choosing Your State

If your absolute top priority is

Nevada, while offering robust asset protection and strong anti-piercing laws, requires additional steps and fees (like the use of a nominee manager) to achieve the same level of anonymity that Wyoming provides by default. Nevada might be the choice for an existing business relocating to take advantage of the state's zero corporate income tax environment, but for a new business seeking pure privacy and low administrative overhead, Wyoming remains the better choice.

Ultimately, while both states are leaders in the field, Wyoming provides a simpler, cheaper, and inherently more private framework for the vast majority of entrepreneurs seeking to protect their identity and assets.