For high-volume, active market participants, the line between an enthusiastic investor and a professional day trader is razor-thin—until tax season hits. The IRS has a specific classification known as Trader Tax Status (TTS) that can unlock massive deductions not available to regular investors. However, achieving and managing this status requires a structured approach, and for many, forming a Limited Liability Company (LLC) is the professional choice to manage legal risks and maximize tax benefits.

This guide dives deep into the strategic use of an LLC for day traders, focusing specifically on how this structure integrates with the powerful financial advantage of Trader Tax Status. Understanding this combination is critical for transforming trading from a sophisticated hobby into a legitimate, tax-optimized business.

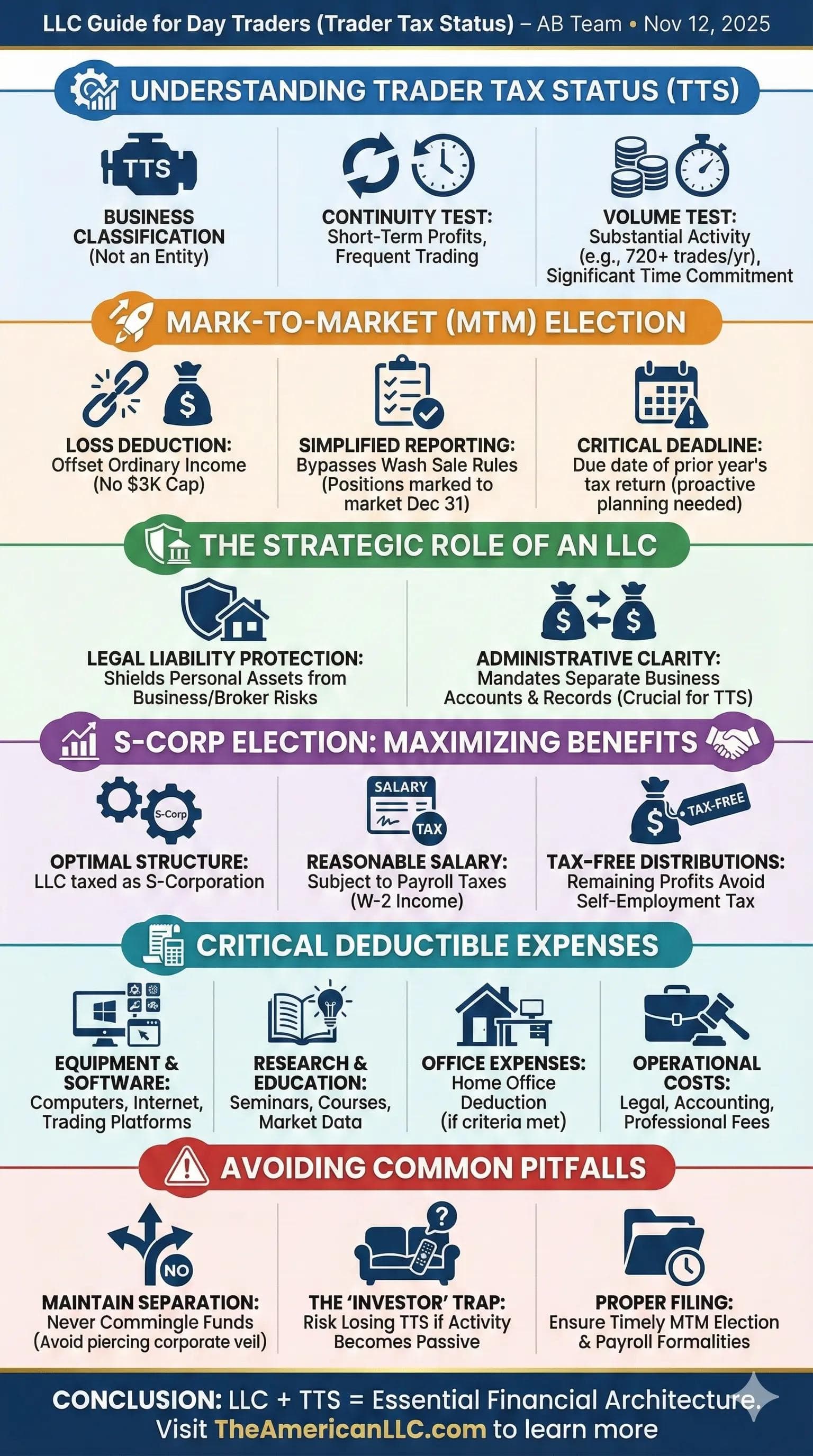

Understanding Trader Tax Status (TTS)

Trader Tax Status (TTS) is not an entity type; it is a classification granted by the IRS based on the nature and frequency of your trading activity. If you qualify for TTS, your trading is treated as a business, allowing you to deduct business expenses and potentially elect the powerful Mark-to-Market accounting method.

How to Qualify for TTS

The IRS applies two primary tests to determine if a trader qualifies, both of which require regularity, continuity, and substantiality in trading:

- Continuity Test: You must seek to profit from short-term price fluctuations, not long-term appreciation, and trade regularly throughout the year.

- Volume Test: While the IRS does not set hard numbers, general guidance suggests you must execute a substantial number of trades (e.g., 720 trades or more annually) and spend a significant amount of time dedicated to trading (e.g., four hours daily, five days a week). The activity must be your primary source of income, or at least a significant financial commitment.

Crucially, if you qualify for TTS, you can elect to use the Mark-to-Market (MTM) accounting method. This is where the major tax benefits lie.

The Power of Mark-to-Market (MTM) Election

Under default tax rules, traders treat trading losses as capital losses, which are limited to $3,000 per year against ordinary income. With TTS and the MTM election, this limitation disappears:

- Loss Deduction: Any net trading losses are treated as ordinary business losses, which can fully offset any type of ordinary income (W-2 salary, consulting income, etc.), providing a significant tax shield.

- Simplified Reporting: MTM bypasses the complexity of tracking wash sale rules for securities, as all positions are deemed sold at fair market value on December 31st.

The deadline to make the MTM election is typically the due date of your previous year’s tax return (excluding extensions), making proactive planning essential.

The Strategic Role of an LLC for Day Traders

If Trader Tax Status is the engine of tax savings, the LLC is the protective chassis that holds it all together. However, an LLC itself does not grant TTS, nor does it automatically change your tax status; it is primarily a tool for liability and professionalism.

1. Legal Liability Protection

The primary benefit of an LLC is shielding your personal assets from business risks. While trading risks are financial (market losses), the legal risks come from administrative actions:

- Broker Disputes: If you face a lawsuit or arbitration from a broker, service provider, or technology platform, the LLC acts as the defendant, protecting your home and personal savings.

- Contractual Risks: Entering into agreements for software, market data feeds, or co-location services is done under the LLC’s name, isolating the risk from you personally.

- Professional Image: Operating as a formalized business entity enhances your administrative professionalism, which is beneficial when dealing with financial institutions or facing an IRS audit related to your TTS claim.

2. Administrative Clarity

The IRS demands rigorous segregation of business and personal finances to maintain TTS. An LLC mandates this separation through its core requirements:

- Separate Bank Accounts: You must open a dedicated business bank account using the LLC’s Employer Identification Number (EIN). All trading capital and operational expenses must flow through this account.

- Meticulous Record Keeping: The LLC structure encourages formal expense tracking, which is essential for maximizing deductions and defending your TTS status if challenged.

The S-Corp Election: Maximizing TTS Benefits

For many qualified day traders, the optimal structure is a Multi-Member LLC taxed as an S-Corporation. This combines the operational simplicity and liability protection of an LLC with the massive payroll tax savings of an S-Corp, especially when combined with TTS.

Why an S-Corp Election is Crucial for TTS

As a sole proprietor or a single-member LLC, profits are generally subject to self-employment tax (15.3% Social Security and Medicare taxes). If you qualify for TTS and conduct your trading business through an LLC electing S-Corp status, you can strategically save on this tax:

- Reasonable Salary: The S-Corp requires you to pay yourself a "reasonable salary" (W-2 income), which is subject to payroll taxes.

- Tax-Free Distributions: Any remaining profits in the S-Corp are taken as distributions, which are NOT subject to self-employment taxes, allowing you to legally keep a significantly larger portion of your net income.

This dual structure—LLC for simplicity and liability, S-Corp election for tax optimization—is often the gold standard for high-net-worth day traders.

Critical Deductible Expenses for Your Trading LLC

Once you operate under an LLC with TTS, you can deduct a wide array of ordinary and necessary business expenses. These deductions further reduce your overall taxable income.

- Equipment and Software: Deducting the full cost of computers, monitors, high-speed internet, and specialized trading platforms.

- Research and Education: Costs for financial seminars, trading courses, and market research subscriptions.

- Office Expenses: If you meet the strict criteria, you can claim the home office deduction.

- Operational Costs: Legal, accounting, and professional fees related to setting up and maintaining the LLC and filing for TTS.

Avoiding Common Pitfalls

While the benefits are significant, maintaining the TTS-LLC structure requires vigilance:

- Maintain Separation: Never use the LLC’s funds for personal expenses or commingle trading accounts. This negligence can lead to "piercing the corporate veil," voiding your liability protection.

- The "Investor" Trap: If your trading activity drops, or if the IRS deems your efforts passive (i.e., you hire a manager to trade for you), you risk losing TTS, which means a loss of MTM benefits and business expense deductions.

- Proper Filing: Ensure the MTM election is filed correctly and on time. If you use the S-Corp election, you must adhere to payroll formalities, including issuing W-2s and making regular tax deposits.

Conclusion

For the serious, high-volume day trader, the combination of a Limited Liability Company and the coveted Trader Tax Status is essential financial architecture. The LLC provides the necessary legal separation and administrative rigor, while TTS—particularly with the Mark-to-Market election—allows trading losses to offset ordinary income, dramatically lowering your tax liability. By formalizing your activity, adhering to corporate compliance, and maximizing your business deductions, you move beyond the limitations of a casual investor and establish your trading as the legitimate, professional business it is.